A mortgage or car loan are examples of installment accounts, requiring a set amount to be paid in full each month. While having a variety of credit types can improve your credit mix, you should avoid taking on more credit for that reason alone. Understanding how credit mix works and its role in your credit score can help you make better decisions toward your financial health.

What’s the Best Way to Use Credit Cards to Boost Your Score?

Credit mix is the variety of types of credit accounts that a person has. It’s one of the factors that lenders consider when assessing a borrower’s creditworthiness and typically includes different types of credit, like credit cards, installment loans, mortgages, and car loans. Successfully maintaining a diverse mix of types of credit may positively impact your credit scores. For instance, closing the account may affect your debt to credit ratio, or the amount of credit you’re using compared to the total amount available to you. Keeping the account open and using it occasionally may help maintain a healthy credit mix.

Credit Card Debt

Installment loans are more rigid—you make a fixed number of payments over an agreed amount of time. For example, if you take out a personal loan for $5,000, you’d likely have to make monthly payments for a set number of years. The lifespan of the loan depends on the terms and conditions you agree to. A diverse credit mix improves your credit score because it shows lenders that you are capable of handling different types of credit.

How important a factor is credit mix for your scores?

- A note of caution, though, in regards to both secured credit cards and passbook loans.

- Million people in the U.S. do not have credit scores, which means they likely don’t have any form of credit account.

- Simply put, credit mix means the various types of credit accounts you own.

- Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- It’s generally not worth it if you don’t intend to use the account or it means you’ll end up paying extra interest or fees.

- Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

CreditWise Alerts are based on changes to your TransUnion and Experian® credit reports and information we find on the dark web. It’s important to keep in mind, though, that if you default on any of these loans, the lender may send the debt to a collection agency, and it’ll be reported as a collection account. We believe everyone should be able to make financial decisions with confidence. Instead, focus on managing existing accounts responsibly for the best score impact. Experian Boost only affects your Experian score and won’t impact scores with Equifax or TransUnion.

With that in mind, here are seven ways to improve your credit score, how much impact they’ll have and how long it can take to start seeing results. When you or a prospective lender pulls your credit report, there’s a list of all the credit accounts that exist (or have existed) in your name. Adopting good credit habits that align with credit scoring factors and sticking to them over the long haul is the key to steady credit score improvement. To monitor your progress, you can sign up for free credit monitoring from Experian.

How to Improve Your Credit Score

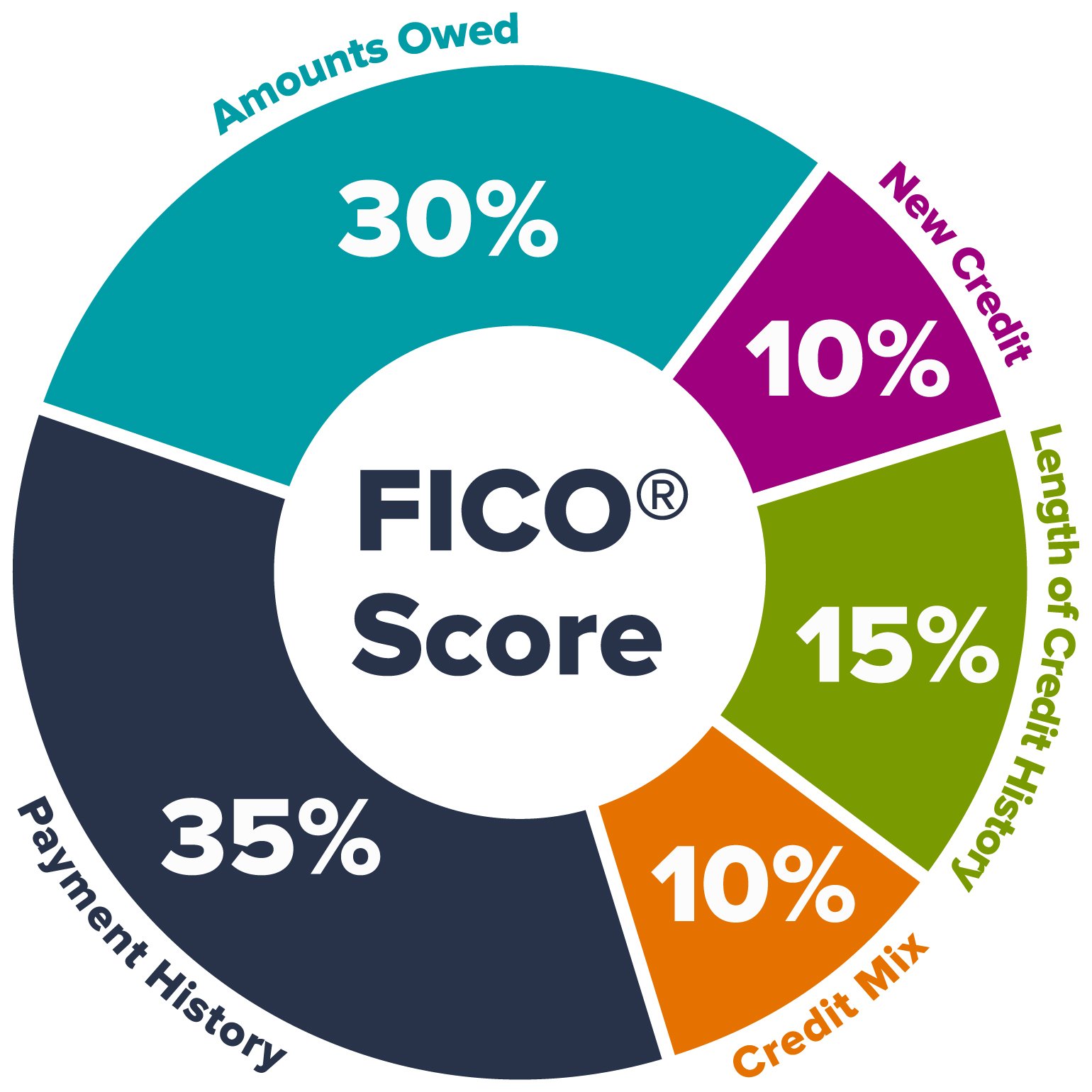

The two most utilized credit scoring methods — FICO and VantageScore — factor your ability to manage different types of credit and loans into your credit score. CreditCards.com credit ranges are derived from FICO® Score 8, which is one of many different types of credit scores. If you apply for a credit card, the lender may use a different credit score when considering your application for credit. When your credit card issuer reports to the credit bureaus may affect your credit score if you carry a high balance. FICO considers all those types of accounts in its credit scoring model, even on-time rental payments if they’re reported to a credit bureau.

Having too few accounts, having only one kind of account, or unnecessarily closing your accounts could damage the credit mix portion of your score. You can also pay off your installment loans at the agreed upon steady rate as opposed to paying off a loan in full if you have the money to do so. A good credit mix is credit diversity, or a blend of revolving and installment credit. Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry.

Along with the initial FICO score drop that can happen when the lender checks your credit — what’s known as a hard inquiry — there is the danger that you won’t be able to handle that credit responsibly. Based on FICO’s research, having various types of debt isn’t the strongest predictor of whether a consumer will repay loans, but it is helpful. Now that you know more about credit mix, check out the last FICO Score how does credit mix affect credit score factor, new credit. Again, since credit mix is only 10% of your FICO Score, it most likely won’t determine whether or not you obtain credit from lenders. However, if you’re striving to bring your FICO Score to the highest level it can be, your credit mix can play a part. The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International.

Leave a Reply