- The attention pricing you will be currently spending: It is preferable to make certain you can actually spend less because of the consolidating your mortgage loans or any other costs. Look at the rates of interest on the current financing and you may compare them to the cost a loan provider does present. Essentially, the fresh new prices might possibly be less than your pricing. If you don’t, combination most likely does not make sense for your requirements.

- The house’s really worth: The value of your home identifies simply how much you might borrow and if you can acquire sufficient to pay-off your own almost every other costs. Preferably, your home can get increased from inside the worth since you purchased, meaning you borrowed from reduced in it than it’s really worth. Having combination to the office, new house’s really worth have to be over your balance toward the key home loan and what you owe on a second home loan short term loans Prichard Alabama and other bills. An assessment is part of the latest refinancing procedure. In case the appraiser will not well worth the house sufficient, refinancing was from the table.

Remember that almost every other debt consolidating selection don’t require your to help you re-finance your financial. If you’re looking to locate a far greater rate with the highest-desire credit debt, you happen to be eligible for a balance transfer credit which have a great 0% basic price.

Ideas on how to Mix One or two Mortgage loans

The entire process of combining your property money otherwise refinancing so you’re able to consolidate other styles of obligations will be very just like bringing an excellent mortgage the very first time. Check around to discover the best mortgage possibilities and make sure you put your top application send:

1. Review Their Re-finance Possibilities

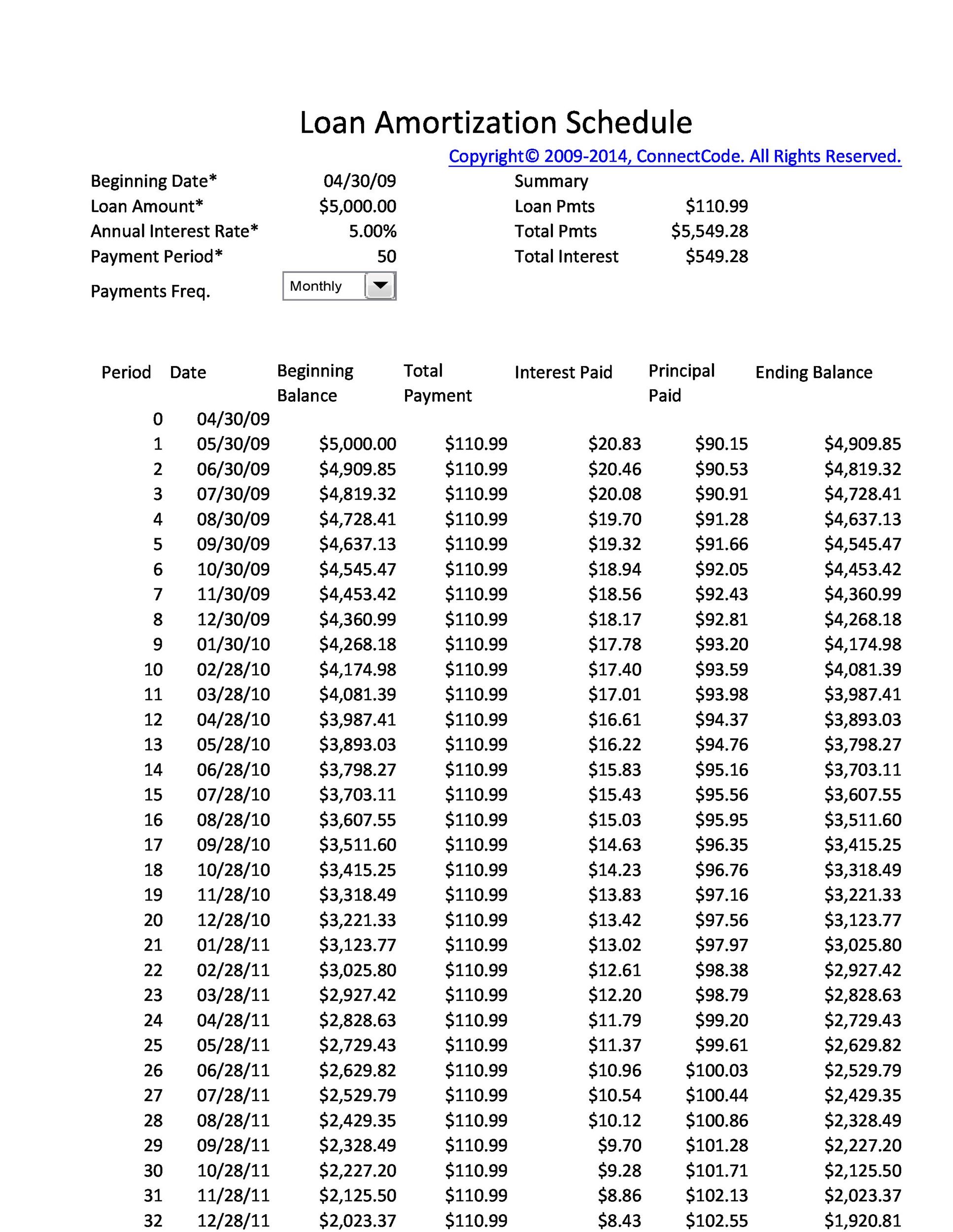

Early the fresh combination techniques, have a look at the many refinancing solutions. Basically, there are two categories of refinancing. The first is a speed and you can title re-finance. Once you get an increase and term refinance, you alter sometimes the interest rate or even the duration of the newest home loan, or in some cases, one another. You could potentially make use of a reduced interest, which often form straight down monthly premiums.

For folks who replace the label, you can either score down monthly payments for people who increase away from an effective fifteen-seasons to help you a 30-season financial, or higher repayments, for individuals who key away from a 30-seasons so you’re able to good 15-12 months mortgage. Constantly, a rate and you can term loan wouldn’t spend adequate for you to use it in order to consolidate multiple mortgage loans or other costs.

If you are intending towards consolidating numerous expense, you’ll likely want to apply for a money-aside re-finance. Which have a finances-away refinance, you might make use of the fresh equity of your home. The amount of a profit-aside refinance exceeds what you owe into latest financial, so you can utilize the extra cash to repay other fund.

To get a money-off to re-finance, you should have a lot of collateral in the home. Constantly, a loan provider won’t agree to lend your more than 80% of your own residence’s worthy of. When you already are obligated to pay 80% or higher on your house – such, your debt $180,000 to your a home worthy of $2 hundred,000 – an earnings-away refinance is probably perhaps not an alternative.

2. Sign up for the fresh Refinance mortgage

When your credit is where you desire it to be, you have selected the sort of loan you desire and you can you’ve receive a lender that has providing the best price, it is the right time to conduct the applying. Obtaining a good refinancing otherwise combination loan is a great deal eg applying for home financing to start with. Their lender should get a hold of proof of income, property and you may employment. He’s attending name that be certain that suggestions or perhaps to inquire about most paperwork as required. They might including telephone call your employer to confirm their work background.

Leave a Reply