And then it makes the payment of $1,500 to settle this debt on 22 July 2019. The receipt includes a description and the number of items included in the shipment. When the item is received, the vendor should include a shipping receipt. To work productively, you need to design an efficient system to manage the payment process.

How To Decide Which Account To Debit And Which Account To Credit In Journal Entries?

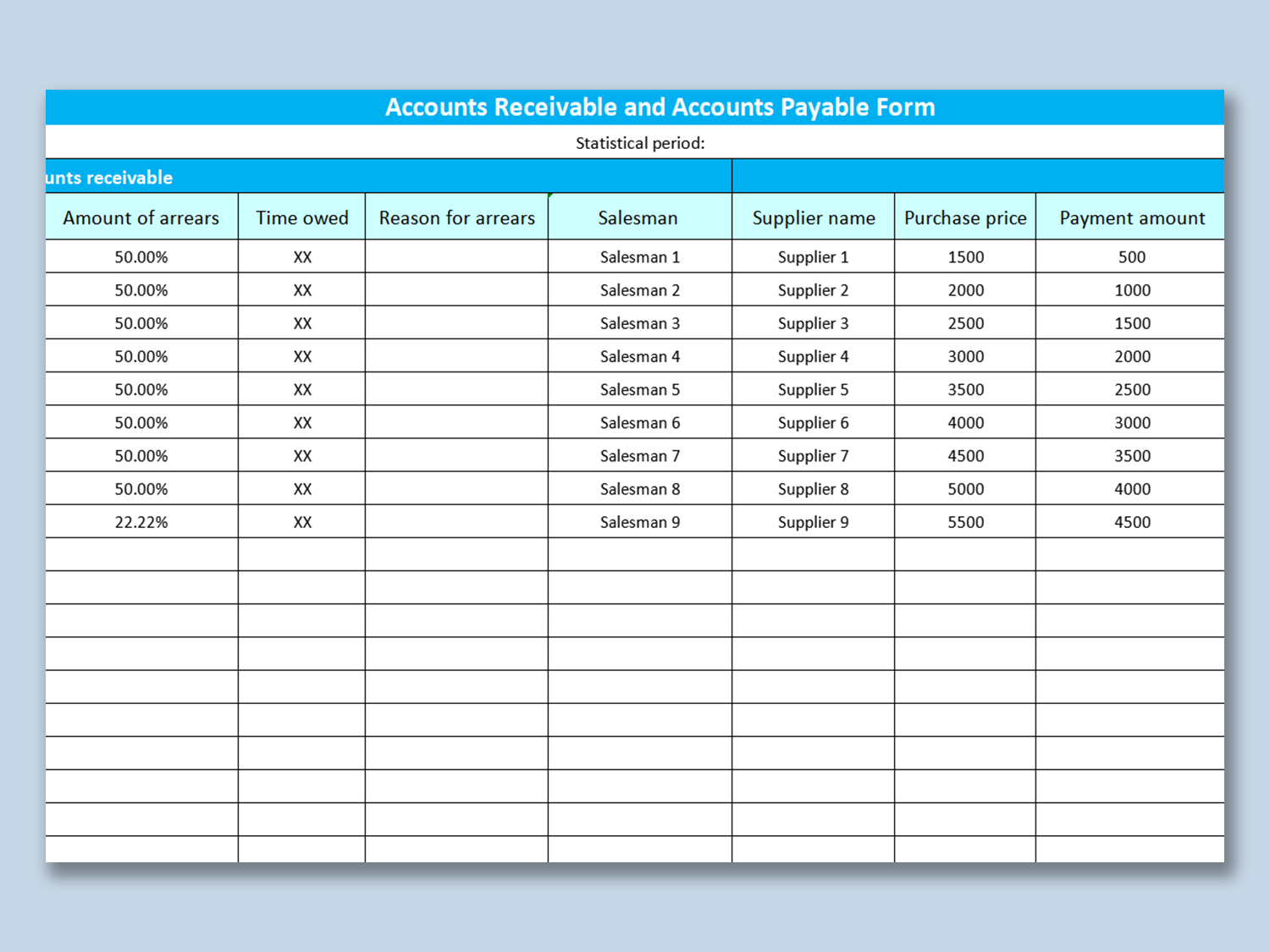

CDE company will record this amount as an accounts receivable in their books as this money they will receive from ABC company. However, trades payable refers to the 2021 guide to selling products online obligations for purchases made for direct trade costs such as inventory and raw material. Suppose the company received a discount from suppliers for early payments.

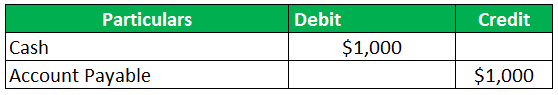

Journal Entry to Make a Cash Payment to a Supplier

Further, the clerk undertakes the processing, verifying, and reconciling the invoices. Also, he pays suppliers by scheduling pay checks and ensures that payment is received for outstanding credit. Accounts payable is a general ledger account that showcases the amount of money that you owe to your creditors/suppliers.

Balance Sheet

In small companies, the entire process is done by the accounts payable manager. However, in big organizations, each step will be executed by different accounts payable executives. Once the bills are verified, the company can decide to make payments to one or several vendors. At this stage, the company will dispatch payment cheques or transfer funds to the suppliers. The accounts payable will show an accumulated balance of all short-term invoice balances. The most common item is included in the balance of outstanding invoices of a company.

- To work productively, you need to design an efficient system to manage the payment process.

- In some companies, approval is required before issuing a payment voucher to the vendor.

- Whenever a business purchases inventory, raw material, or other supplies on credit, a transaction can be recorded for the AP account.

- The candidate should explain the purpose of the entry, any challenges encountered, and the accounts involved.

- The system automatically updates with the latest tax rates and rules, and provides proactive alerts when action is needed to maintain compliance.

- These balances come from suppliers from whom they purchase on credit.

General Ledger Account: Accounts Payable

Whenever a business makes purchases on credit, the liabilities increase, reflecting in the accounts payable. The payroll clearing account is a temporary holding account used during the payroll process. It is credited when gross wages are recorded, and then debited when net pay is actually disbursed to employees. A payroll clearing journal entry, then, is the entry that “clears out” this account, moving the funds to the company’s main cash account. After this entry is posted, the payroll clearing account should have a zero balance.

Accounts Payable Journal Entries Vs Accounts Receivable Journal Entries

AP automation will also help to reduce human errors and increase efficiency. All companies must implement AP automation software to streamline the accounts payable process. Implementing accounts payable automation software will eliminate most of the paperwork involved in bookkeeping. According to the general accounting principles, all businesses are supposed to clear accounts payable by the due date as it is their current liabilities. If any business is unable to pay the amount in the short term due to some financial issues, they can talk to their vendor and inform them about the delay in payment.

The AP department is also responsible for maintaining good relations with vendors by making timely payments. The accounts payable department needs to develop strategies to save the business money by negotiating discounts by making early payments for the purchase invoice. Additionally, the accounts payable department also negotiates credit terms with the vendors.

The offsetting credit is made to the cash account, which also decreases the cash balance. Say, for instance, you receive invoices from your suppliers, these supplier invoices would be recorded as credits to your accounts payable account. These transactions would then increase the credit balance of your accounts payable, so by paying your suppliers in cash, your accounts payable balance will get reduced.

Leave a Reply