Revelation declaration

D. Brian Empty can not work for, consult, very own shares during the or receive financing out of any business or organisation who does make the most of this information, and has shared zero associated associations past their instructional meeting.

People

Into price of borrowing from the bank currency to find a property or an automible inching ever before large, facts just who becomes entry to borrowing, and at just what interest, is far more important for borrowers’ economic health than before. Loan providers base those people conclusion for the borrowers’ credit scores.

For more information on fico scores, The Conversation consulted with one or two funds students. Brian Blank are an assistant professor from finance within Mississippi County School with options associated with just how enterprises allocate funding, together with character away from credit when you look at the home loan lending. His colleague within Mississippi State, Tom Miller Jr., is a loans professor who has got authored a text into the individual lending, plus providing his options to policymakers.

Credit reporting assesses the possibilities of default

Some individuals constantly create punctual money, while others is actually slow to settle, whilst still being someone else default meaning they do not pay-off the money they borrowed. Loan providers have a robust providers bonus to split up money that be paid straight back away from loans that could be paid.

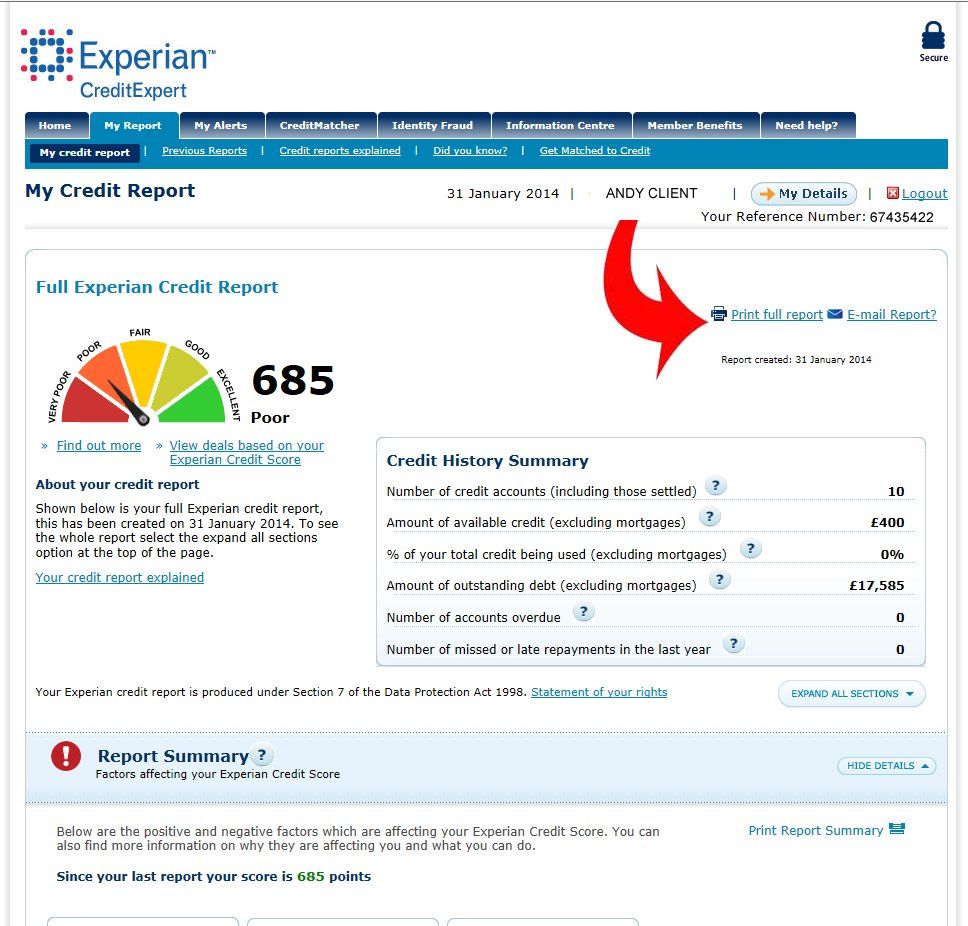

So how do lenders identify anywhere between a great borrowers and you may risky of them? They believe in certain proprietary credit scoring expertise that use past borrower repayment records and other things to predict the likelihood of future cost. The three communities you to monitor fico scores about You.S. try Transunion, Experian and you can Equifax.

Even though twenty-six billion off 258 million borrowing-qualified Us citizens run out of a credit score, whoever has ever before opened credit cards and other borrowing from the bank membership, such as for instance financing, has that. A lot of people lack a credit rating in advance of turning 18, which is the many years individuals can start beginning credit cards in their label. Although not, people continue to have zero borrowing from the bank after in daily life once they haven’t any makes up about revealing businesses to evaluate.

Credit scores just overview how well anyone pay back debt throughout the years. Predicated on that installment choices, the credit scoring system assigns people just one number between three hundred so you’re able to 850. A credit rating ranging from 670 in order to 739 tends to be considered becoming an excellent, a get on the listing of 580 so you can 669 is judged fair, and you will a rating below 579 is actually classified worst, otherwise subprime.

The two key issues for the credit ratings is actually just how on time earlier in the day bills was paid down therefore the number the person owes into latest financial obligation. The newest get and additionally considers the combine and length of borrowing, and additionally how brand new its.

Credit scores might help lenders decide what interest giving consumers. And may affect banks’ behavior towards access to mortgages, credit cards and you may automobile financing.

Present developments into the credit rating results

Mediocre fico scores in the us have risen off 688 into the 2005 to 716 as of . They lived steady at that height as a result of 2022.

When you find yourself credit card debt was at a record large, an average user is using only more a fourth of one’s rotating borrowing that they had availability as of .

As of 2021, almost half of You.S. customers got ratings experienced decent meaning throughout the list of 740 so you’re able to 799 otherwise sophisticated (800-850). Half dozen into the 10 Us citizens has a get above 700, similar to the general pattern from checklist-setting credit ratings of history long-time. This type of styles might, to some extent, reflect the latest apps that can note when people shell out costs such as for instance rent and tools promptly, which will surely help improve ratings.

Leave a Reply