The loan title plus cannot be three to five weeks unless your own total payment cannot surpass the more out-of (i) 5.0% of one’s affirmed disgusting month-to-month earnings otherwise (ii) 6.0% of your own affirmed online monthly earnings. Your car or truck name mortgage might possibly be repayable from inside the substantially equal monthly payments out of dominating, costs, and you may attention combined.

Appeal, Charge, and Costs: An automobile identity lender are allowed to charge you (i) attention during the a simple yearly price to not ever exceed 36%; and you may (ii) a monthly repairs commission that will not meet or exceed new minimal from $15 otherwise 8.0% of originally developed amount borrowed, provided the maintenance fee is not put in your loan equilibrium about what attract was recharged. As well as desire plus the monthly fix commission, a car label financial can charge your a deposit product return percentage into the actual number sustained because of the automobile identity financial, not to ever surpass $twenty five, if your examine or digital commission is returned delinquent just like the membership on which it actually was drawn are finalized by you otherwise contains insufficient loans, or if you eliminated payment to the glance at or electronic percentage.

If you make a cost more than eight calendar weeks after their due date, a car or truck title financial ount of your fee, but not to meet or exceed $20.

Remember that in case the in the first place contracted loan amount is $step 1,500 or faster, a vehicle identity lender don’t charges or located from you a whole quantity of charge and you may charges more than fifty% of your own amount borrowed. In the event the amount borrowed is over $1,500, the amount of fees and you will charge you should never exceed 60% of one’s loan amount.

An automobile identity lender are blocked regarding accruing otherwise asking you attention into the otherwise just after (i) the brand new big date the new motor vehicle name lender or men acting for the financial institution repossesses the car; or (ii) 60 days once you neglect to generate a payment per month toward your loan, unless you’re concealing the car.

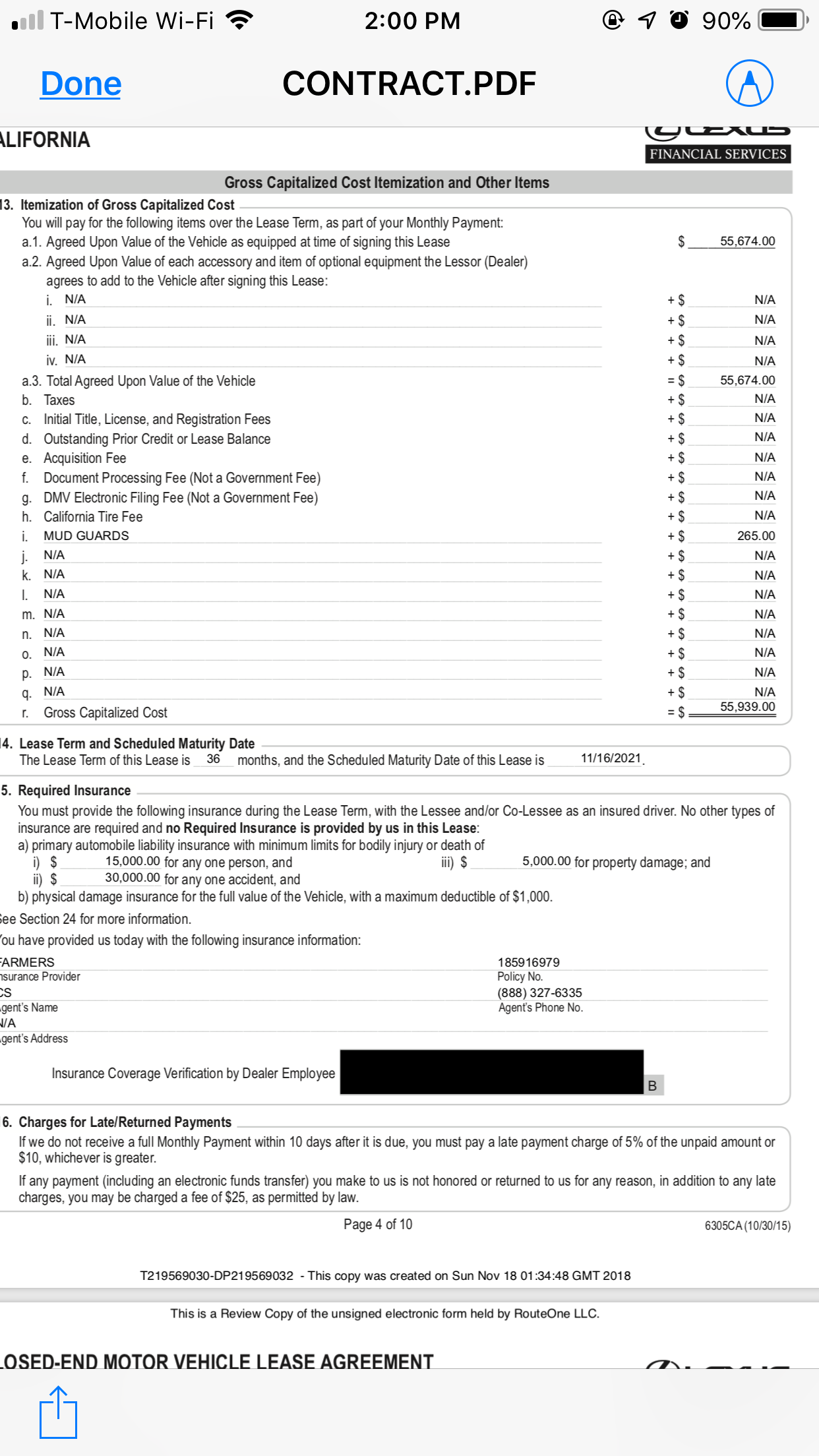

Written Financing Arrangement: An automible name bank should provide your with an authored loan agreement, which have to be signed of the both you and an authorized representative of one’s automotive label financial

Aside from focus in addition to can cost you especially stated within area in addition to part below (“Will set you back regarding Repossession and you may Revenue”), no additional quantity tends to be energized, accumulated, otherwise acquired because of the an auto name lender.

The interest, fees, and you can charge stated contained in this part may possibly not be energized, gathered, or received unless of course he’s used in your own created mortgage agreement.

not, the quantity recharged for you toward repossession and you can product sales of one’s motor vehicle cannot exceed 5.0% of one’s originally contracted loan amount. An auto label bank was banned from asking getting people stores will set you back when your automobile label bank requires fingers of your own automotive.

A vehicle term lender ought to provide you having a copy of the signed financing contract

Your vehicle title mortgage contract are a binding, court document that requires you to repay your loan. Make sure you read the entire financing arrangement cautiously before you sign and you will matchmaking they. If any supply of your loan contract violates Part twenty two ( 6.2-2200 ainsi que seq.) out-of Title Missouri loans 6.2 of Code out-of Virginia, the supply are not enforceable facing you.

Assets Insurance policies: A car or truck title lender might require you to get otherwise look after property insurance rates for the automobile. However, a motor vehicle identity lender never need you to purchase or manage property insurance policies from otherwise compliment of a particular provider or record away from business.

Leave a Reply