Just as we wouldn’t expect someone who ordered a salad to subsidize another’s expensive steak, in business we need systematic ways to allocate costs to the departments and projects that actually drive them. This process is crucial for informed decision-making and maintaining operational efficiency. Using cost allocation, you can determine which areas of your company are over or under-spending and how changes to specific processes will affect the overall profitability of a product or department. Now assume that the actual number of purchase orders completed during the period was 290 for the Cooking Department and 100 for the Canning Department.

Common Mistakes People Make When Allocating Costs

Also assume that actual costs for purchasing and receiving are $60,000 fixed costs and $39,000 variable costs. Which of the stage I methods is more useful from the service cost perspective, i.e., for “make or buy” decisions? The net realizable value method and NRV less an average profit margin method are not needed in this case because the products have identifiable market values at the split-offpoint. After the simultaneous equations have been solved, the allocations to the producing departments are easily determined by hand as follows.

Create a Free Account and Ask Any Financial Question

Circle the letter of the best answer for each of the following questions. Assume that S1 represents the total costs of the Power & Maintenance (P&M) Departmentafter all service department allocations to P&M. S2 refers to the total costs of the Building Occupancy (BO) Department after all service departmentallocations to BO. P1 represents the total costs of the Assembly Department after all service department allocations. Finally, P2 refers to the total costsof the Painting Department after all service department allocations.

Cost allocation methods

However, in reality, this may not always be the case, as complex interactions can exist among cost centers. Every division gets exactly the allocation method that makes sense for their specific costs. The result is a more accurate picture of your true total costs, without the administrative burden of managing multiple systems or complex calculations.

- From the service cost perspective, the differences are more significant.

- This problem is eliminated by using the single budgeted rate method illustrated below.

- After the simultaneous equations have been solved, the allocations to the producing departments are easily determined by hand as follows.

- (See Exhibit 6-1 and See the Baggaley & Maskell summary for an illustration of support functions within a manufacturing environment).

- Whether your business is booming or experiencing a quiet period, expenses like monthly rent, loan instalments, and base salaries remain constant.

Ask a Financial Professional Any Question

This clarity transforms vague financial estimates into precise insights. Distribution can track the costs of delivering goods in full and on time. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Is there any other context you can provide?

In addition, the inventory values are acceptable from the financial reporting perspective. Thus, from these two perspectives, thismethod is better than the other three. 1) Develop equations for each department fully recognizing all the reciprocal relationships and self services. The equations for the reciprocal method are also developed fromequations [1] and [2] above. However, there are some differences in the values that appear in the equations. First, the service department costs (Siand Sj) are different because all of the self service and reciprocal relationships are considered in determining these amounts.

But the real power lies in what you can do with this real-time data. Instead of waiting for month-end financial reports, you can monitor specific costs as they happen, spot trends and anomalies instantly, model different scenarios before making changes, and generate stakeholder reports on demand. Even the best cost allocation system can fail if it’s working with outdated or incomplete data.

In addition, theproportions (Kji) in both sets of equations are different for the same reason. The proportions reflect all of the relationships in the reciprocalmethod, instead of only part of the relationships as in the step-down method. The XY Company uses the step method for allocating the costs of its service departments to operating departments. The company has two service departments and two operating departments.

Solve cost allocation problems using plant wide and departmental overhead rates. A second method, frequently referred to as the traditional two stage allocation approach, recognizes that there are service areas and producing areas in the plant. Usually, only one what tax forms do i need to file taxes overhead rate is developed for each producing department, although the basis for these rates may differ betweendepartments. The various producing departments might use direct labor hours, equivalent units, material costs or machine hours, as an allocation basis.

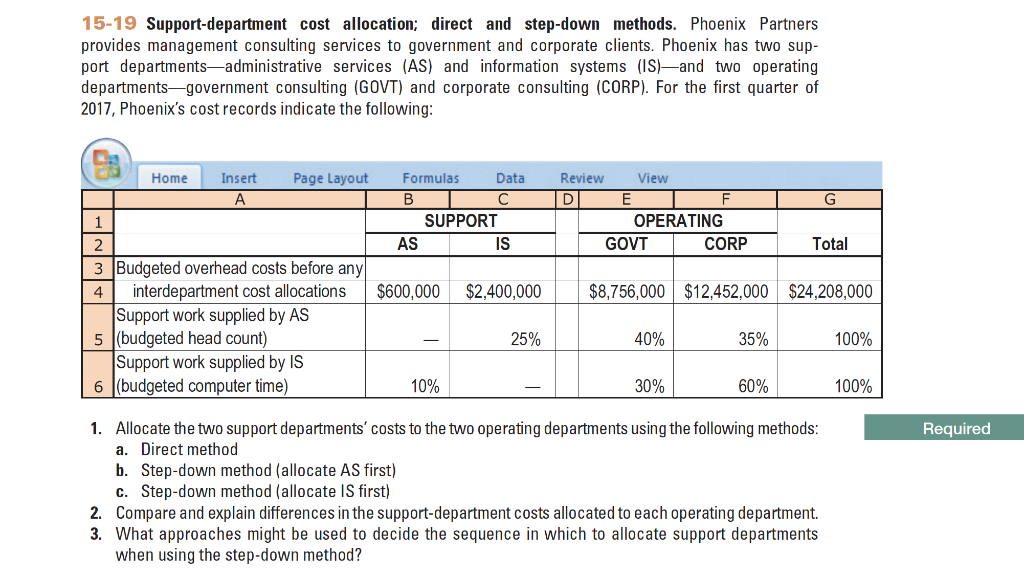

Hierarchical organizations commonly employ the step-down method, which sequentially allocates costs, considers interdependencies among cost centers, and reflects the resource flow. This method recognizes service provisions between centers, ensuring a more accurate allocation process. Allocate the service department costs to both service departments and producing departments based on the allocation proportions provided in Table 1. Show the allocations from each service department to each service and producing department, including self-service and the costs after all allocations have been made. The Virginia Chicken Company combines a poultry business with a chain of restaurants that specialize in southern fried chicken. Two joint products emerge at the point of separation,or split-off point.

On the otherhand, maintenance costs are understated by $17,261 using the direct method and $6,150 using the step-down method. These differences are likely to besignificant in terms of evaluating the service department costs, particularly in cases where a “make or buy” (outsourcing) decision is involved. We can allocate using a couple of different methods of allocation. So the hours incurred by administrative departments such as payroll, purchasing, accounting and HR, would be allocated, based on the number of hours worked in each of the operating departments and allocated accordingly.

Leave a Reply