Homeownership in Pennsylvania besides provides a place to label household but also offers the opportunity to generate equity. When you find yourself a citizen trying to power the brand new security you dependent, House Collateral Funds (The guy Loans) and House Collateral Credit lines (HELOCs) try effective financial devices to take on. Contained in this guide, we’re going to discuss this new ins and outs of He Fund and you may HELOCs, taking expertise having Pennsylvania customers drawn to unlocking the value into the their houses.

Expertise Family Security

House security was a good homeowner’s need for their house, symbolizing the difference between brand new residence’s market price as well as the the financial equilibrium. In Pennsylvania, where possessions philosophy may go through movement, expertise and you will leverage see this it collateral is vital to to make informed monetary conclusion.

In terms of opening house collateral, a couple of top choices are Home Security Financing (He Fund) and Domestic Collateral Lines of credit (HELOCs). He Funds promote a lump sum payment amount having a fixed attention rates, leading them to best for prepared costs such home home improvements. Simultaneously, HELOCs promote an excellent revolving credit line, providing autonomy getting ongoing needs such education expenditures or unforeseen will cost you. Pennsylvania home owners is to meticulously consider the financial specifications before choosing ranging from these selection.

Qualifications Standards to have The guy Fund and HELOCs in Pennsylvania

So you can qualify for He Funds otherwise HELOCs for the Pennsylvania residents generally speaking you would like a robust credit rating, a good debt-to-income ratio, and you can an adequate amount of guarantee in their property. Local loan providers, such as those into Morty’s program, provide customized guidance based on personal economic activities and also the book areas of the fresh new Pennsylvania housing market.

Tips Apply for He Money and HELOCs

The application processes to have He Fund and HELOCs involves get together papers, such proof of money and you can assets valuation. Pennsylvania owners may benefit away from handling local mortgage officials exactly who understand the subtleties of your own state’s real estate market. Morty, an online home loan broker, connects individuals which have local financing officers, making certain a personalized and you will efficient app procedure. With Morty, home owners could even feel a swift closing, into possibility to intimate toward an excellent HELOC in the only a small amount because the 14 days.

Determining Loan Numbers and Interest rates

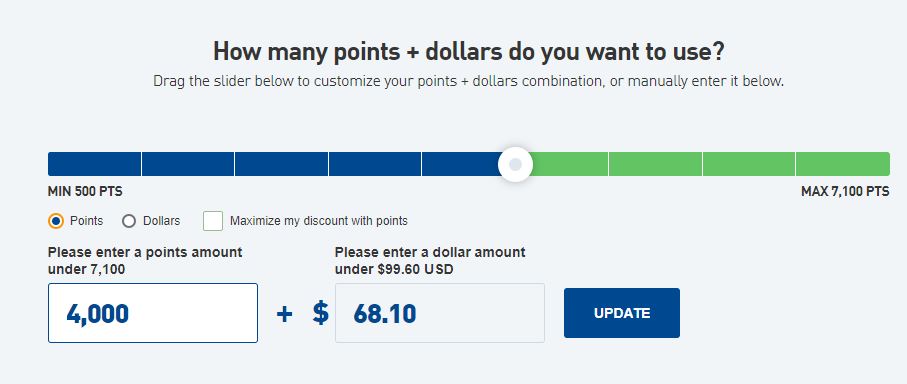

The loan wide variety and you may interest rates to possess He Fund and you will HELOCs trust individuals things, such as the number of security, creditworthiness, and you will markets conditions. Pennsylvania people will benefit on the competitive rates offered by local lenders, especially when making use of on line programs for example Morty you to definitely improve the credit processes.

Popular Purposes for The guy Funds and HELOCs

Pennsylvania homeowners commonly utilize The guy Fund otherwise HELOCs to possess a selection off objectives. Off capital renovations to merging large-focus debt otherwise coating education expenses, these monetary tools supply the freedom needed to get to some economic wants.

Considerations

While he Fund and you will HELOCs render high positives, it’s critical for property owners to be aware of dangers. In control explore is key, and you may knowing the terms, possible alterations in interest levels, together with chance of property foreclosure in the event of fee standard try crucial. Regional financing officers, obtainable because of Morty, offer tips about in control borrowing.

Unlocking home guarantee as a consequence of The guy Money or HELOCs within the Pennsylvania needs consideration and you can told choice-while making. From the understanding the differences when considering these types of options, seeing regional loan officials, and ultizing online programs such as for instance Morty, residents normally power the collateral to achieve their financial requires responsibly. Consider, an important is always to align these types of monetary units together with your novel products and you may goals.

Should you want to be lead to a local mortgage administrator close by, perform a merchant account into the Morty today! No tension, free, just high local options and you may service!

Leave a Reply