A go through the available evidence and the chronic gaps, and additionally subject areas to have future analysis

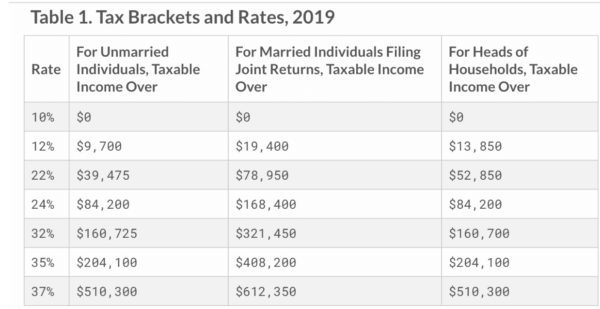

- Table from Content

Analysis

People throughout the U.S. play with a mortgage out of a financial or other financial institution so you’re able to financing a property pick. But tens out-of millions of Us citizens have made use of alternative resource agreements, in which consumers make repayments to providers. Research means that a factor operating this type of consumers to help you alternative financial support-quite a few of just who are well enough creditworthy to find a mortgage-is actually a lack of such mortgage loans, specifically for quantity less than $150,000.

Providers apparently market these types of choices once the an alternate path so you’re able to homeownership, however, studies have shown one to option plans can harm homeowners. 1 Yet not, brand new the total amount from you’ll benefits and dangers of solution resource is difficult to assess as the decreased is famous regarding the the effects, their frequency, the costs one to consumers incur, otherwise just how many customers at some point finish holding obvious term to their homes.

Typical choice investment arrangements, like house contracts, seller-financed mortgages, lease-get preparations, and private property financing, range from mortgage loans in essential indicates. To your purposes of it study, a mortgage are a bona fide house pick borrowing from the bank agreement you to definitely generally speaking pertains to a 3rd-team lender who has zero earlier or other demand for brand new property separate regarding the loan and may conform to federal and you can state laws. In the financial transactions, term, that’s, full courtroom ownership of the property, transmits away from provider to help you visitors at the same time the borrowed funds is initiated. By comparison, certain prominent solution arrangements, such as, belongings deals, commonly susceptible to significant rules, along with instructions by using these type of funding, owner-rather than the buyer, like in a home loan exchange-provides new deed on property throughout the brand new money term. And because of several jurisdictions dont imagine consumers becoming residents whenever they do not officially hold identity and have the action at hand, people may not have obvious possession or know with certainty just who is responsible for possessions taxation and you can repairs.

Consumers off are built homes can get come across similar problem as they manage never individual the residential property where Recommended Site the home sits. However, regardless of the household particular, with no advantage of standard defenses the legislation gives so you can popular home loan consumers, users exactly who explore option funding agreements can be face steep pressures.

Since the a first step toward most readily useful understanding the details of option funding contracts, families’ knowledge when using all of them, brand new available research, and you may people chronic degree gaps, This new Pew Charity Trusts analyzed the relevant books. Since this brief summarizes, the present look shows that option plans are usually an unhealthy substitute for conventional financing.

However, this comment and revealed that so much more data is needed to see as to why some buyers enter into alternative agreements and to what the quantity the newest thought of experts happen.

What’s alternative resource?

People turn-to alternative a home loan for the majority of explanations, together with complications acquiring a mortgage while they have busted otherwise minimal borrowing records otherwise since the loan providers within their urban area often give few small home loans or possess unattainably higher underwriting requirements. 2 Various other instances, potential homeowners may not want a mortgage or might have been considering the option to buy the house while located in they since the a tenant. step 3 Centered on Pew’s data of associated books and discussions having judge benefits on the country, a portion of the sorts of option resource is actually:

- Home deals. Throughout these plans, known as contracts-fotherwise-deed or fees sales deals, the consumer will pay normal installment payments to the merchant, often to own a decideded upon time period, although action does not import at the outset in the most common states; instead, the seller retains full ownership of the property till the final fee is made, leaving the buyer instead of obvious rights in order to often the house or the new guarantee that has accrued. 4 Among option financing solutions, belongings deals have obtained many notice regarding teachers and you can legislators. Due to this, which review is based heavily with the homes price search. Although not, because of the similarities one of alternative resource arrangements, brand new findings-specifically those concerning your pressures to own consumers together with current evidence gaps-is actually mostly relevant some other brand of alternative agreements.

Leave a Reply